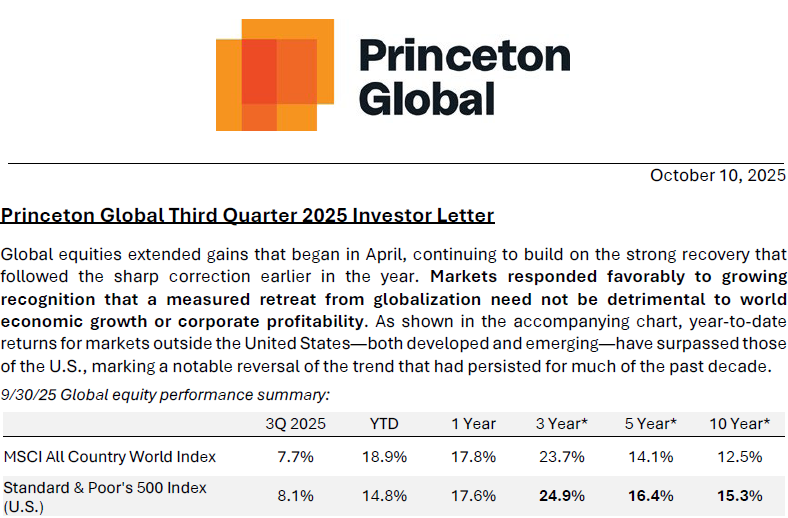

The third quarter of 2025 continued the strong rebound that began in April, with global equities advancing further and international markets outperforming the U.S. for the first time in years. Investors gained confidence that a gradual pullback from globalization and a measured pace of monetary easing could sustain both economic growth and corporate profitability.

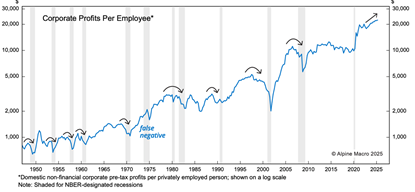

The economic backdrop remains healthy despite short-term political noise, such as the U.S. government’s partial shutdown. Consumer spending is steady, business investment in AI infrastructure is strong, and productivity gains are beginning to show up in earnings, summed up in the chart below:

Source: Alpine Macro

We have welcomed the market recovery while maintaining a balanced, diversified approach—recognizing that periods of strength are best navigated with discipline and perspective. In the attached letter, we discuss:

- The emergence of a productivity boom driven by technology-enabled efficiency gains.

- While U.S. stock valuations appear full, we believe they are supported by solid underlying earnings growth.

- A closer look at how AI is influencing market returns and the broader economy, along with our near- and long-term approach to the most affected industries.

- The continued appeal of short- to intermediate-term bond portfolios that balance yield, stability, and flexibility.

Please contact us if you want a copy of the entire letter.