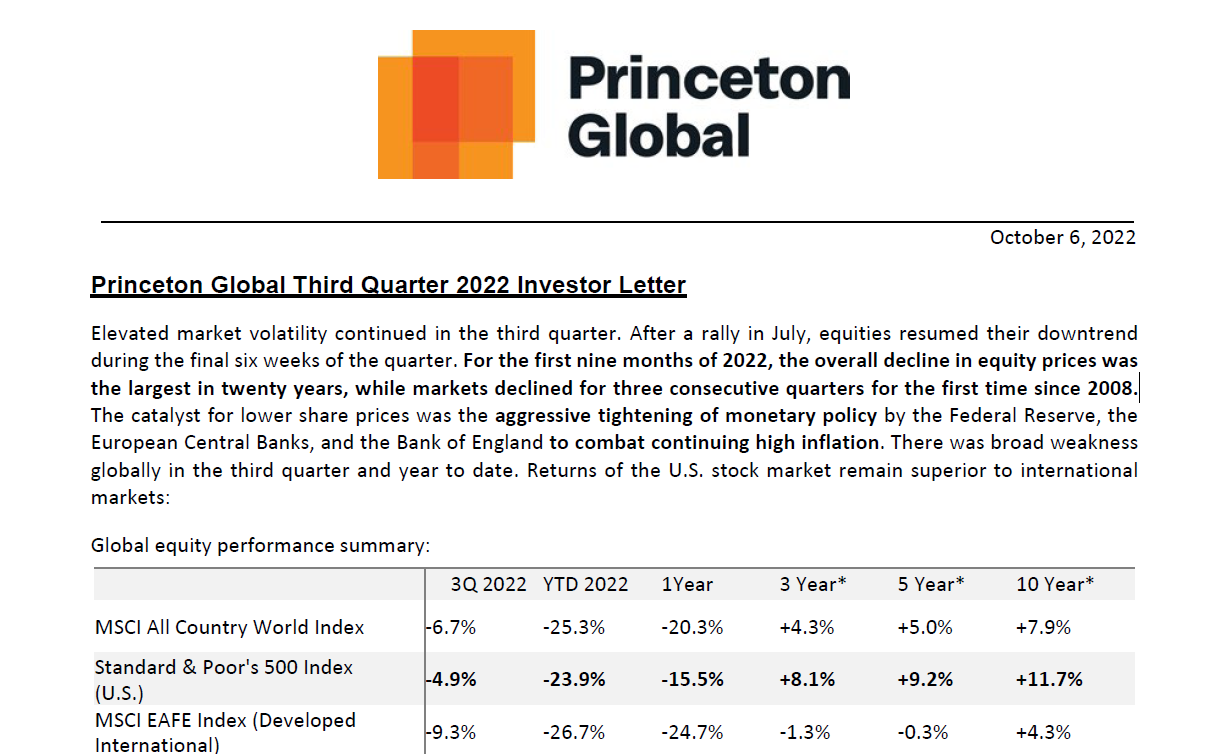

The financial markets have been relentless in the year’s first nine months. Market downturns are not enjoyable for anyone, and everything from stock prices to the media and even friends challenges our conviction to be long-term investors. While we cannot be sure how the future will play out, buying stocks when volatility is high, and the market is down has historically worked well for investors.

There is plenty to be concerned about in the world these days. However, we have been here before and are genuinely optimistic heading into the year-end and beyond, seeing investment opportunities across asset classes.

A few highlights of our client letter include:

• We break down the major “buckets” of inflation and explain why inflation rates will likely ease in the coming months and quarters.

• The Federal Reserve’s “hawkish blitz” has been unprecedented, and the probability for a “policy error” recession has increased – which necessarily isn’t bad forward-looking;

• We see extreme pessimism, increasing the potential for a recovery rally in equities;

• Regardless of political views, midterm elections can be a positive catalyst;

• Shorter-term bonds have reached even more attractive levels than a quarter ago and remain our preference for fixed income investing.

Please contact us if you want a copy of the entire letter.