As the first quarter of 2023 ends, it appears that Spring has finally arrived. We hope you and your family are enjoying the change of seasons as much as we are in Princeton.

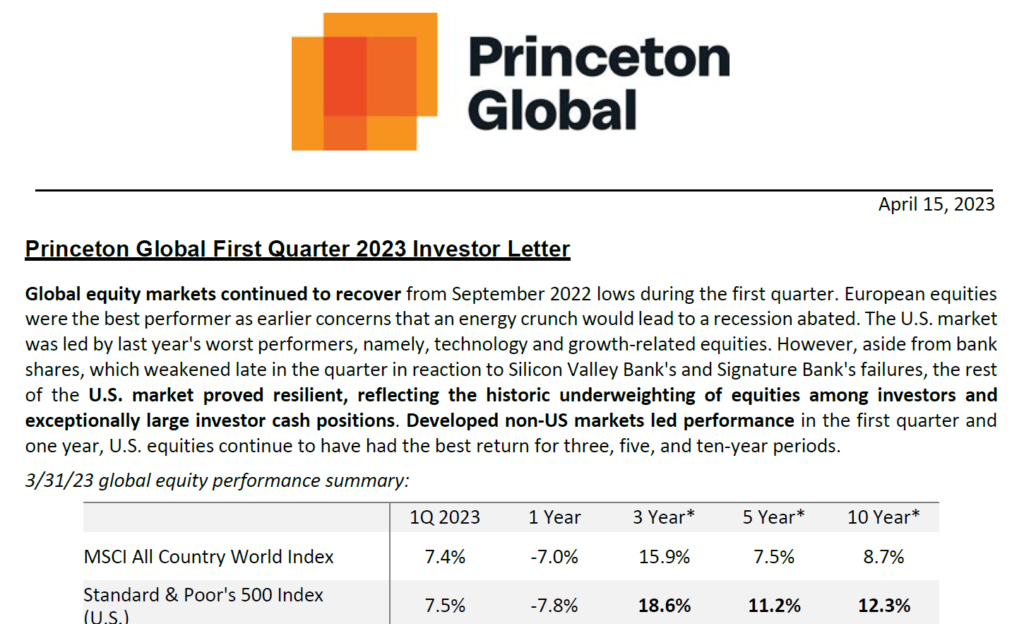

Despite facing many high-profile challenges, equity and fixed income markets have progressed toward recovery. The current market environment is frustrating both bullish and bearish sentiments, and we expect the current volatility to persist throughout the year as investors try to parse economic news and global events.

Within this noise, we are constructive on global equities and are seeking promising long-term investment opportunities. We are pleased higher short-term interest rates provide attractive returns for balanced portfolios and cushion for investors looking to proceed deliberately. There is a tremendous amount of money on the sidelines, and much of this cash has left banks and now resides in brokerage accounts, which should support future market rallies.

Our attached letter details the current investment environment and our analysis. We realize not everyone is interested in the minutiae (hopefully, that is why you are working with us!), we wanted to share highlights for those interested, including:

- Evidence further supports the U.S. economy is slowing while the inflation rate is gradually declining.

- The first quarter was a mirror of 2022 and reminded us that consensus views are often incorrect, and patience is a vital investing virtue.

- We provide context on the banking failures and the economic and investing implications.

- In fixed income, we remain focused on investing in shorter-term bonds and have helped many clients find attractive yields for cash savings.

Please contact us if you want a copy of the entire letter.